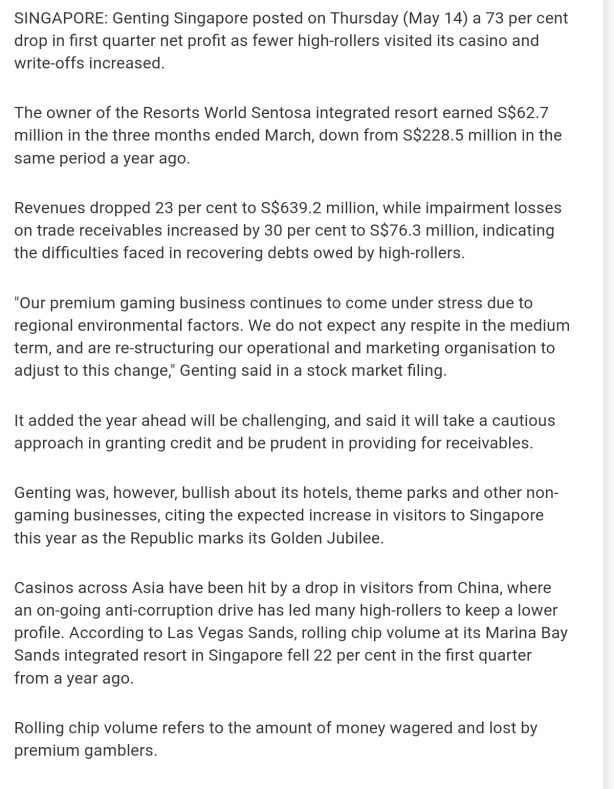

The above news report exactly highlights the following big weaknesses of Genting Singapore Casino:

– Very weak in managing the IMA ( internal marketing agents, ie. Junket Opetators).

– Very weak in optimising mass gaming floor and table efficiency.

– Very lack of systematic tools in acquisition and debt collection with regard to premium market gaming patrons.

Genting’s inerrant problems ( as stated above) coupled with economy woes, it is not surprised at all that they continue to post bad results.