Commentary by: Professional Ground

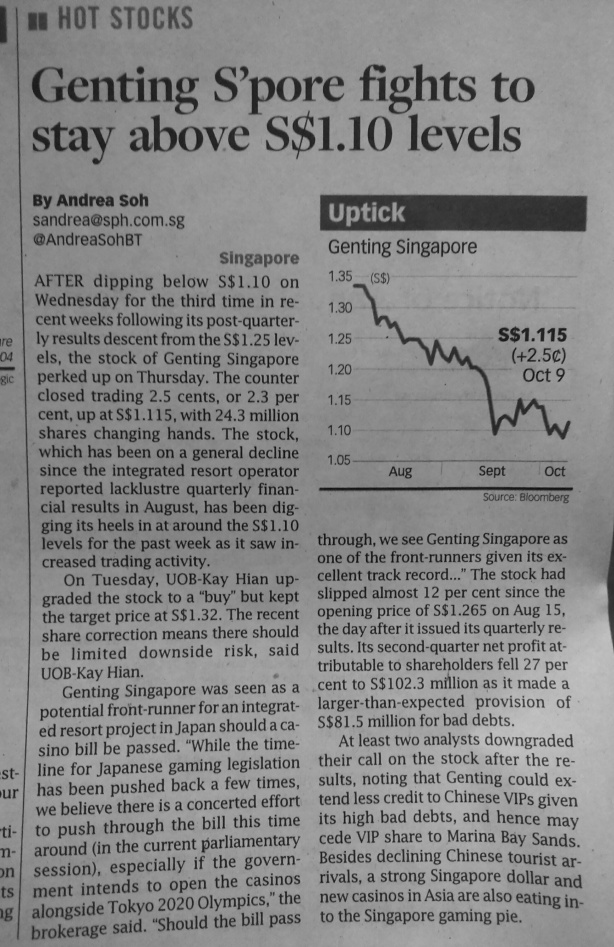

Our assessment of Genting Singapore RWS casino revenue / profitability is even more pessimistic than the general evaluation of investment analysts.

Reasons are simple, as follows:

~ the credit crunch in China will NOT be lifted in near future as in 2015 or 2016. This is based on the key policy by the Chinese premier Li, in that he needs to revert the over heated Chinese domestic market due to over leveraging on bank credits. The control measures will stay for at least next two years.

~ it is a very different scenario from Macau enclave, RWS Genting has very limited capacity to bring into their casino, what we called ‘sustainable high volume’ non~negotiable chips play! Therefore, their over~crediting and associated credit risk exposure will continue to loom.

~ RWS Genting apparently is still very weak in the two critical revenue churning practices:

a. Lack of floor efficiency to generate high enough HOLD % on its mass gaming floor!

b. Lack of powerful Junket partners to SUSTAIN high enough rolling chips turnover in order to increase its VIP programs WIN %!

So, for the next two years at least, there’s a long shallow casts overhead on Sentosa RWS casino….

Forget all ths BS about ‘Chinese high~rollers wild card’. Simply put, RWS is dealt with a Bad Hand!